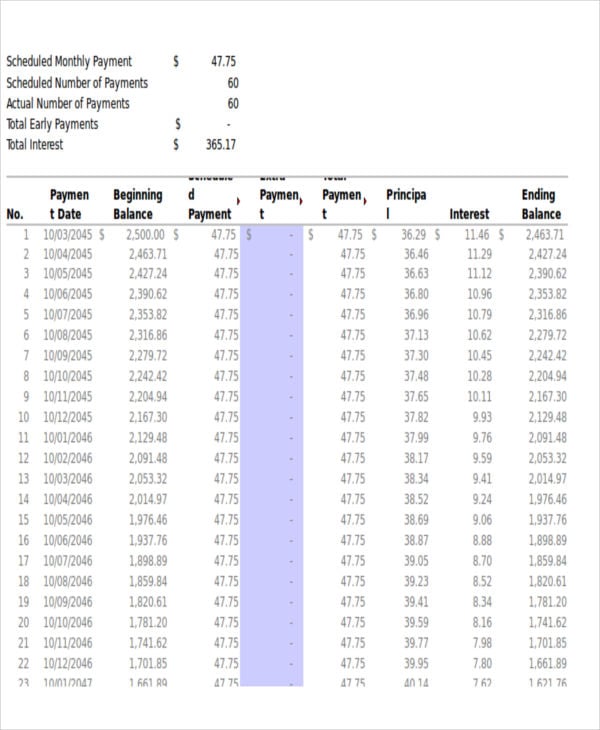

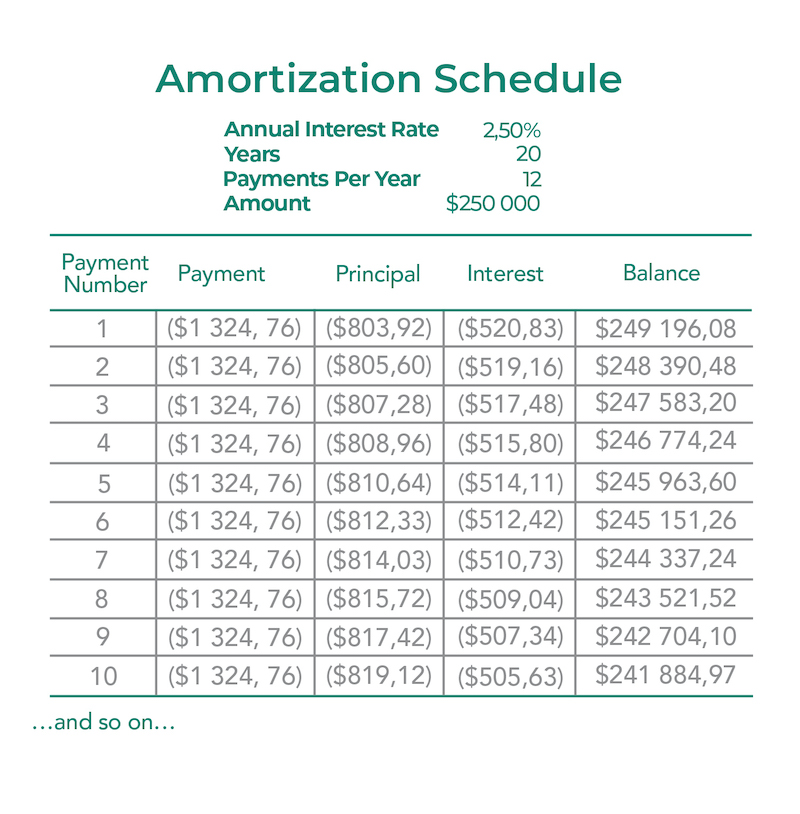

This will often remain constant over the term of the loan. The payment is the monthly obligation calculated above.This amount is either the original amount of the loan or the amount carried over from the prior month (last month's ending loan balance equals this month's beginning loan balance). The beginning loan balance is the amount of debt owed at the beginning of the period.This may either be shown as a payment number (i.e., Payment 1, Payment 2, etc.) or a date (i.e. This column helps a borrower and lender understand which payments will be broken down in what ways. However, each row on an amortization represents a payment so if a loan is due bi-weekly or quarterly, the period will be the same. The period is the timing of each loan payment, often represented on a monthly basis.This article describes how this spreadsheet calculates interest payments (the article is targeted at mortgages, but the theory and math is exactly the same). Just change the compounding period to suit! This flexibility means that you can use this calculator internationally. This alters the amount of each payment, and the total interest paid at the end of the loan. Australian loans are compounded monthly.Canadian loans are compounded monthly or sometimes semi-annually.So what this this auto payment calculator do better than the other calculators you can find littering the Internet? Well, you can change the compounding period of the loan.

This tool also generates a payment schedule, giving the date of each payment (and the interest and principal paid of every payment, and the balance). Watch me use the spreadsheet in this video.

Want to know how much that new car will cost? Just crack open Excel and load this spreadsheet.

0 kommentar(er)

0 kommentar(er)